If you don't CPP me now, you will never CPP me again...

Hi there.

You don’t know what Canada Pension Plan (CPP) is. This is a statement of fact, not an opinion.

I am speaking directly to Danielle Smith, her caucus and her handlers at TBA (the Take Back Alberta party). Unfortunately I am also, probably speaking to you, dear reader. You have no idea what the Canada Pension Plan is, how good it is that it exists, why it exists and frankly have probably been lied to for the last 30 or so years, if not longer, about whether or not you will benefit.

For the last number of years, the Alberta government, majority run by the United Conservative Party (UCP) has mused about pulling out of CPP. In 2021, they put our tax dollars into a report to see if it would be a good idea to set up an Alberta Pension Plan (APP) that would remove Alberta’s contributions to the program, and have AimCo (the Alberta Investment Management Corporation) manage the funds on behalf of Albertans'. The simple concept is, that Albertans pay more into CPP that the rest of the country, and it is unfair that we collect the same amount as other Canadians in retirement.

In fact, they even have put out a “survey” as to whether or not we ought to move ahead with this. Unfortunately, the “survey” doesn’t even ask this question. You can take it as many times as you like, and the questions are deceptive. See it here: UCP APP SURVEY

Please follow the directions carefully, their scaling is backwards and misleading.

The NDP, our provinces official opposition, has also put out a very straightforward survey, please indulge yourself here: NDP APP SURVEY

While generally speaking, we as a province are somewhat younger on average than most other provinces, and in fact do have a higher median income, simplifying the argument down to just these two parameters is reductionist and silly.

However, with this as a basis, the UCP has decided to ignore the actual problems we have as Albertans, such as but not limited to; the highest energy prices in Canada by up to 4x. A healthcare system that is, for all intents and purposes, set to collapse and ready to privatize, as planned. An education system that shares a similar fate to that of our healthcare system, which is slowly being whittled away by decades of austerity. We will lose our affordability and cost of living advantage (if we haven’t already) do to poor planning, corruption and a lack of will to ensure affordable housing and energy costs. To top it all off, at least in my opinion, we as a country are not serious about infrastructure, and the major municipalities of the province certainly are not taking themselves to task on the subject, while the province shows zero signs of helping out.

Well, I shouldn’t say they’re not doing anything, they’ve convinced Albertans that spending money on luxuries like new arenas is far more important than ensuring Albertans are able to reach their potential in a safe and affordable environment.

I understand what I am saying may ruffle some feathers, as not everyone agrees with my personal political stances, and that is fine. Disagree all you like with what I believe in, but the above mentioned issues are not opinions, these are things happening right now, in our province, that we all saw coming.

To be balanced, here is a great write up from 2021 from Ellen Nygaard and Virendra Gupta that details a lot of what I am talking about in a much more non-partisan manner.

The idea of a transfer of funds from CPP to an APP is nothing more than a smokescreen, a distraction… NINJA SMOKE! This is taking eyes and minds away from the real problems affecting Albertans.

If more people knew more about CPP; more accurately the Canada Pension Plan Investment Board (CCPIB) and how it works, we wouldn’t be talking about this at all.

First things first, we have to get to some false information, the myths about CPP that so many people believe. In no particular order I have listed a few below. Lets do our best to quickly dig into them, I will do my best to provide resources for you to study on your own.

Myth: CPP will be gone by the time you are old enough to collect/ won’t pay you your allotted amount until death.

Every three years, an independent audit is done on the assets/ liabilities of the fund by the Office of the Superintendent of Financial Institutions (OSFI) to asses the long term (75 year) probability of meeting unfunded liabilities.

You can view the 31st version report here: CPP Actuarial Report 2021

In short, the report paints a very positive picture of the next 75 year outlook, that CPPIB will meet its goal of funding retirees pensions in full.

Myth: The government can dip into CPP as they see fit to ensure bills are paid.

Both CPP and CPPIB act completely independent of the federal government, and if fact are the beneficial owners of numerous crown corps (see ImPark)

All contributions for CPP payments go directly to CPP to invest, pay benefits and for administration.

No federal or provincial government may legislate, without prior notice, or place members on the board of CPPIB without prior explicit consent from the board itself.

CPP is among the worlds best run pensions, CPPIB is consistently voted among the best governed pensions on earth, if not the best.

Myth: The government uses excess CPP contributions to fund itself.

There is no such thing as an excess contribution to CPP

The Yearly Maximum Pensionable Earnings (YMPE) level is set in prior years based on inflationary levels and necessities to the fund as per the 3 year audit.

The YMPE for 2023 for instance is $66,600:

Anyone making between ~$3,500 - $66,600/ year, will pay 5.95% into CPP: or anywhere between $208.25 - $3,663 combined with their employer.

Myth: Alberta pays far more into CPP than any other province.

Per capita this is technically true as we do have higher median and average wages in Alberta than the rest of the country in many years and a young but aging workforce.

in reality, Ontario has between 2.5 and 3.3X more YMPE earners than Alberta depending on the year.

This is simply a factor of having nearly 11,000,000 taxpayers vs Alberta’s ~3.1M

As Alberta’s workforce ages, this will become a problem.

There are more Self Employed people per capita in Alberta, but not by a wide margin, many of whom pay themselves dividends which do not qualify them to invest in CPP

Which means some portion of the population does not benefit from CPP.

Myth: CPPIB costs are too high and returns are too low.

While costs seem high, billions per year to manage the fund, you get what you pay for

higher net returns than nearly all funds in Canada over the long term

Most mutual funds cost around 1.5-2%/ year to manage. most ETF’s, a cost effective choice: .75%

CPPIB costs about .6% and has a ten year average of 10%

The reality is, I could go on and on about myths and misinformation about CPP, but the facts are, CPP is the sixth largest pension that exists on earth today. Based on projections it will reach $1,000,000,000,000 (that’s a trillion dollars) before the 2020’s end. CPP, is for every Canadian outside of Quebec, it is not partisan, it is mobile (it moves with you). CPPIB is independent, extremely well managed and frankly in my opinion, something every single Canadian ought to be extremely proud of. It is an exceptionally incredible accomplishment, I would say rivaling or beating any other achievement that has come from Canada and or Canadians.

I would rank our Charter of Rights and Freedoms, our peacekeeping efforts during the 20th century as 1 & 2, closely followed by CPP.

Which brings me to an interesting and final myth, or perhaps “misconception” that is being thrown around a lot.

“Quebec doesn’t pay into CPP, they have their own pension, why don’t we use that as as example for Albertans?”

Easy: QPP began simultaneously alongside CPP. It, like CPP, has been around nearly 60 years. While it has its own successes and challenges, is run independently and also like CPP, is mobile; it faces a challenge that Alberta will eventually face, which would jeopardize the whole thing: people age. Because Quebec has an aging population, their contribution rate is 12.6%, the rest of us pay 5.95% as we are able to spread the risk over ~31,000,000 people. Quebec has more than double the amount of tax filers as Alberta does but faces an uphill battle CPP does not.

Unfunded liabilities at this level aren’t a joke. In the late 80’s through to 1995, numerous think tanks, universities, and CPP/QPP themselves recognized unfunded Liabilities as a massive issue that would essentially ring dry Canadian pensions, CPP in particular if nothing was done, by 2015.

At that time, public pensions run in Canada were essentially mandated to run on government bonds, for the most part. Pensions we know today, looked like this prior to 1999:

You may or may not see the some of the problem here. To be blunt, government bonds may be a relatively stable investment, but with a growing population and the realization in a decade or so, baby boomers would become the largest population of retired people Canada had ever seen going forward: changes were necessary.

Changes that would set the standard for pension investments in Canada, the expansion of responsibilities of CPPIB, allowing them to set their own diversified investment strategy without interference from the government, and soon enough, indexing. Which would ensure that the growth of CPP would outpace withdrawals and other liabilities.

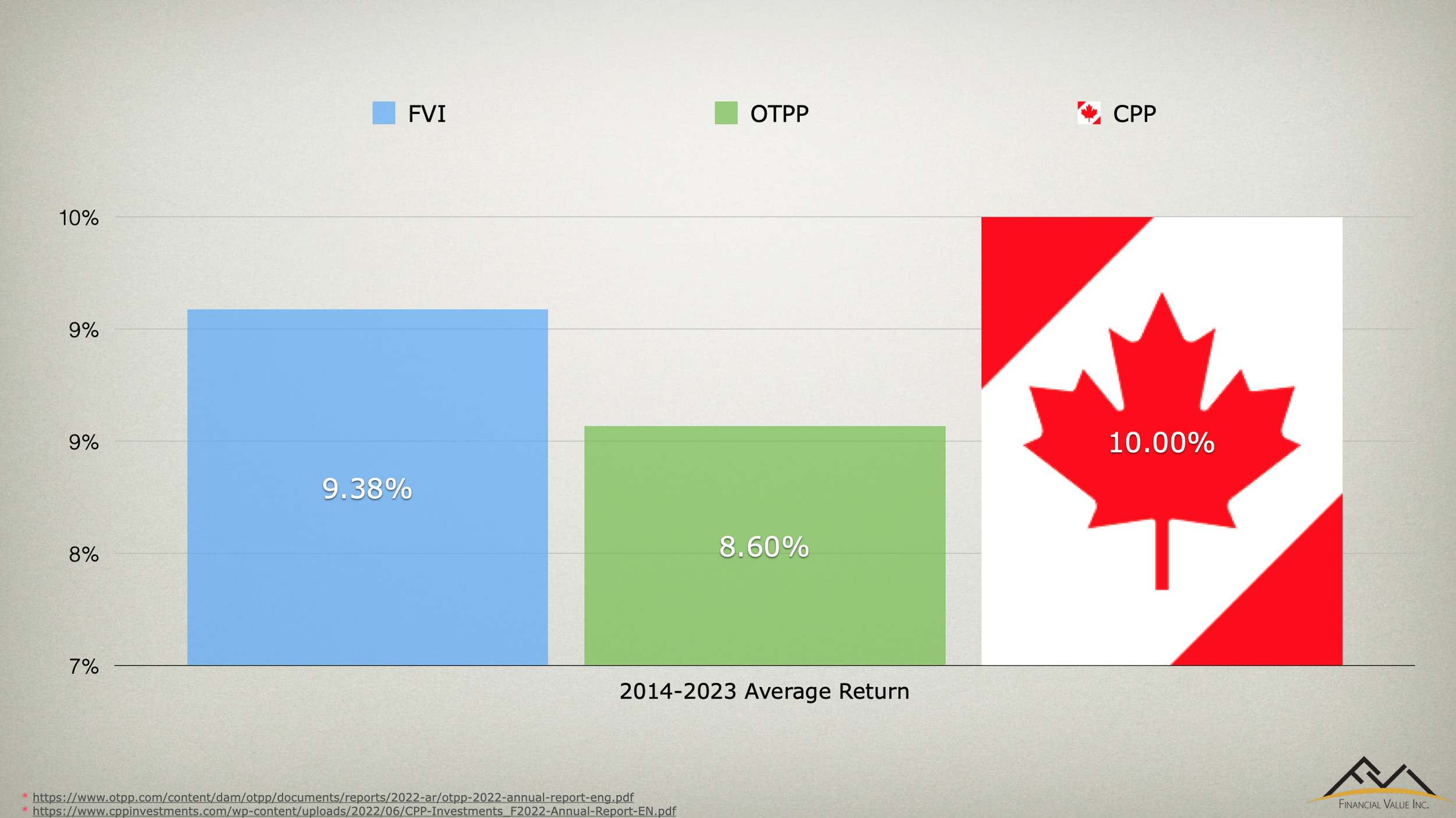

Here is a snapshot of what CPP and the Ontario Teachers Pension Plan (OTPP) look like today. (We at FVI have studied these pensions for decades BTW)

As you can see, this is a wild departure from what pensions looked like, without much change, from 1966-1999. The concepts and progressive ideas brought forward in the mid to late 90’s turned something pretty solid, into something near unbeatable and dare I say; close to indestructible.

The growth of these two pensions, is phenomenal. Indexing does play a part in growing the funds to ensure liabilities are exceeded, but the majority of the growth of these funds comes from returns. See below:

Did you know, 95% of Canadians invest roughly 95% of their money in Canada?

Did you know, of the 95% of Canadians who invest roughly 95% of their money in Canada, invest about 50% of that into savings accounts and GIC’s?

Did you know, most Canadians would absolutely not be able to retire to median mortality without CPP & OAS?

Do you maybe see a reason why?

Returns matter. If CPP and OTPP only invest a small fraction of their funds into Canada, why do you invest nearly all of your money here?

Furthermore, outside of holding cash to invest, do you see such a massive amount invested into money market, GIC’s, High Interest Savings?

Can I plug FVI for a moment? We compete returns wise with CPP and OTPP. We study them and try to copy what they are doing. Below are the average returns of CPP, OTPP and Financial Value’s overall portfolio. While your experience with us may differ, I can tell you, the investors who regularly spend time with us and are on top of their money are working at this level.

While I talk about CPP all the time, I think it is important to shout out to the teachers plan in Ontario. In 1970, one in ten teachers were drawing a pension, today, somewhere near 8 in 10 are drawing a pension, yet it continues to grow at a massive pace. Incredible stuff we have done here in Canada. We represent ~2% of global GDP, yet have 8 of the top 100 largest pensions on earth.

Source: Visual Capitalist

Here are the problems with an APP.

First off and foremost, it isn’t necessary. If so many Albertans are making so much money, and remember they only pay as much as YMPE will allow, 5.95% of $66,600 this year, they shouldn’t be relying on CPP for their retirement at all right? (lol, we spend like drunken sailors in this province, almost no one can retire unless their homes continue to increase in value. But alas, another time, another blog post.)

We already have an incredible device in CPP that ensures income is supplemented in retirement for decades, perhaps forever.

An APP would decimate CPP, according to this abysmal report done by Telus Health (formerly LifeWorks). They were given parameters by the Alberta Government and a paid for mandate to ensure those parameters resulted in specific analysis and results. Says so right in the report BTW. While I am sure Telus Health has a number of fantastic actuaries, this is not their lane.

Regardless, the report shows that Alberta would take the lions share of CPP, funnel it into an APP, and likely have it run by AimCo. (just an FYI, AimCo has a ten year return of 7.3%, compared to CPP’s 10%. Aimco Lost billions of dollars last year, wrote off billions more, and had a return of -3.4% compared to CPP’s return of 6.9%. While this assumption is up in the air, it is in fact Danielle Smiths spoken opinion, that AimCo run it.

If independently run, perhaps AimCo Could take the Hundreds of billions of dollars, and invest more like CPP or OTPP. But here is where things fall apart for that argument. In past sessions, Jason Kenney put in place Bill 22 and later Ministerial Orders, which Smith would later rubber stamp and pour cement over to essentially make it near impossible to change the laws. In effect these legislation make it possible for the Provincial Government to place their own people on the board, which will allow the Provincial Government to interfere directly in the investment process of AimCo. This is something the teachers, teachers union (the ATA) and teachers pension plan (the Alberta Teachers Retirement Fund - ATRF) feared.

AimCo used funds, at the discretion of the provincial government, to invest in Alberta. Doesn’t sound so bad, but effectively, if you were a resource lobbyist, you were about to make a lot of money for yourself.

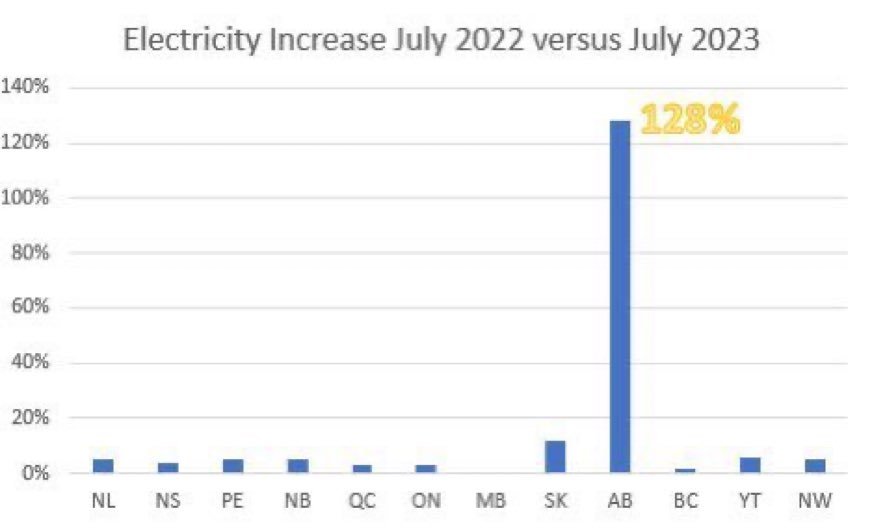

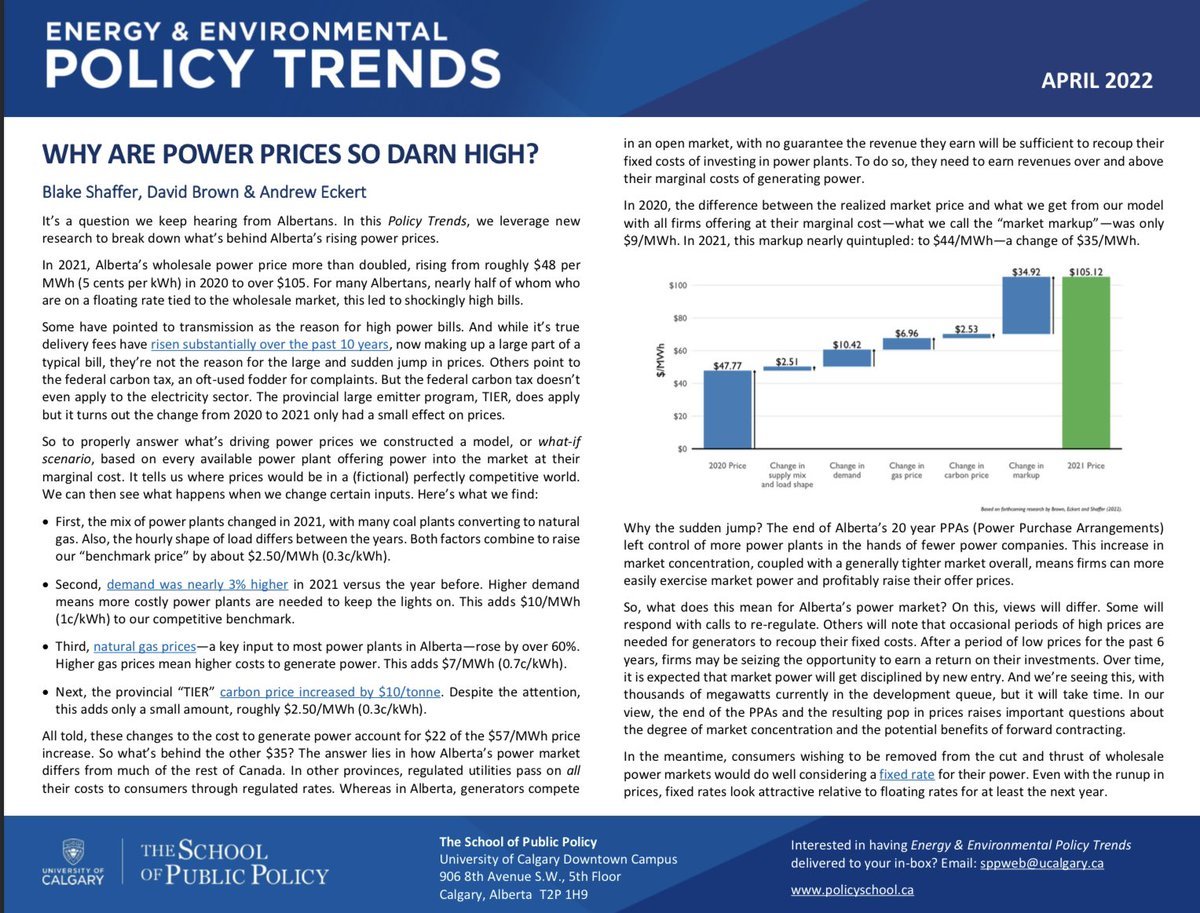

Herein lies the problem. Bill 22, with relation to this blog post did two things. As I mentioned above, it allows for the provincial government to use Ministerial orders to appoint their preferred people, essentially lobby groups to the board of AimCo. This in turn allows them to directly influence how and where to invest. Secondly, it removed legislation that ensured energy companies in Alberta can’t reduce the amount of energy supplied to the system in order to artificially increase power prices (and thus profits). This is called Economic Withholding. Our power regulator, such as it is, is toothless to help Albertans because of this Bill.

I mentioned above that the idea of APP being floated around is a smokescreen. Well, do you look at your power bill? if you do, you will have noticed quite the increase in your energy pricing. Here is a contrast in reality and what our government is telling us. Shout out to @TheRealDKGray on Twitter for the info.

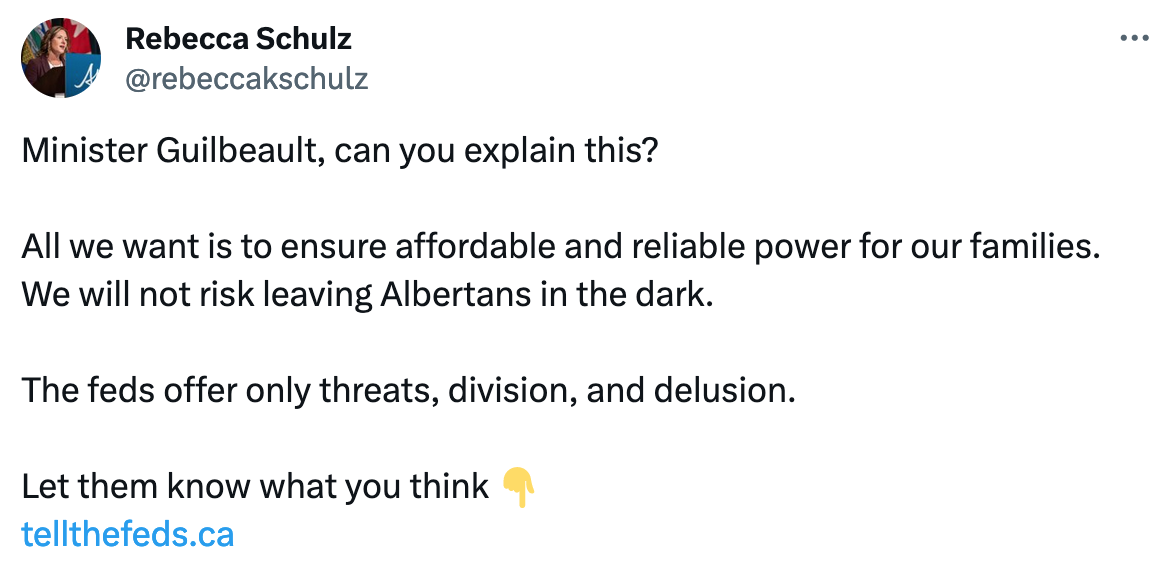

I work in a world of trust. The first thing dad taught me when I entered the industry was that “People want to know how much you care, before they want to know how much you know.” People will generally assume you can be trusted if you are in a position of influence. They shouldn’t, as seen above in a tweet by our minister of the environment, Rebecca Schulz, who blames the feds for our power price spike. So does the premier.

Mrs. Shulz, is currently under investigation because she did not disclose that her husband is a resource industry lobbyist. This is a massive conflict of interest! Every single Albertan should be up in arms about this. But no one is, because of the distraction.

Pensions operate on trust. We trust them to handle our money, and one day funnel it efficiently back to us to supplement our income. Not replace it, supplement it.

Do you trust the current, or for that matter, any Alberta government to do the right thing when they have billions of dollars of lobby money staring them in the face? Do you believe they are acting independently?

Independence is key. There is a reason that the slogan chosen for FVI, and Financial Growth Inc's before it was and remains “The Alternative for Independence”, with so many pressures and forces at play, independence is key. Having people pressuring you to do what they want, or else, is how we end up with Economic Withholding and having 95% of Canadians invest essentially all of their money in Canada, half of it being lent back to them to buy their homes, cars and food. (Why do you think GIC’s and savings accounts exist?)

We already have an incredible tool that supports us, in CPP. We don’t need something that will cost the province billions, and that is before the lawsuits start, and believe me, they will.

Danielle Smith has mused in the past, google it, that she would use an Alberta Pension to fund an Alberta Police Force and Tax collection task force under her discretion. We know this by another term: Gestapo. She has often said that an APP should be used to fund Alberta businesses and the province at large… like Dynalife? Like a pipeline to nowhere? Expired Turkish Tylenol? etc etc etc …

I am only scratching the surface here; we should not look past Smith and her actions, or the actions of the UCP. In an instant, she put roughly 25,000 workers in Alberta on the bread line with the six month moratorium on renewable energy development, which is worth hundreds of billions of dollars to the Alberta economy. Her response?: “six months isn’t that long…” Ostensibly “let them eat cake” is probably not the feedback or leadership, out of work Albertans are looking for.

No one in Alberta asked for this, it was her decision, which she quickly blamed Justin Trudeau by name for, then lambasted the Feds for a date nearly 30 years away to reach carbon neutrality. Fact is, we can’t trust a person and party making decisions, seemingly with the wind, that benefit a small group of donors and not Albertans. This is not independence.

Alberta is young and well paid now, but in two decades, when most of you reading this most will need it most, an APP of any kind will be in grave jeopardy, no matter how well it is run. People age, industry’s die, empires crumble. CPP will outlast us all, we can trust in that. Your children or perhaps it is your grandchildren won’t see a dime from an APP. At least in my opinion.

There is zero chance an APP would cover long term liabilities, and it has already cost us tens of millions of dollars just thinking about it.

I showed some pretty harsh bias here, and while I will not apologize for it, I also have showed a great deal of restraint and have done everything I can to provide evidence and facts to back my opinions. This province faces an already incredibly steep uphill climb, but it is still filled with good people and a lot of money. We can continue to follow the rock covered in bio-luminescent algae (whats up all my Moana fans), or we can focus on what is real and what is achievable. an APP is not achievable, nor is it real. It is no more than a diversion.

If you have gotten this far, I know you have learned something about the Canada Pension Plan, about the Canada Pension Plan Investment Board and about Canadian pensions in general.

Below is a link to find the MLA of your riding, if you feel as passionately about this as I do, or care at all, you ought to be contacting them as well as the premier to let them know your thoughts, whether you support them and a move away from CPP or not. At this time, in this province, we do not have the luxury of not speaking up and out.

I have done my job as an advisor and Albertan.

If the Alberta government decides to move ahead with this plan, I won’t bother with picketing, peaceful protest is meaningless in this day and age. I will be contacting everyone I have ever met across the country and will be raising money for a class action lawsuit. It will be one of thousands.

Trust me.

Darris Cameron,

CEO

Financial Value Inc.