Is History a Crutch?

Our favourite quote factory once said:

“What we learn from history is that people don't learn from history”

I often wonder if Warren Buffet is right about this little piece of wisdom. I wonder if we simply don’t learn from history or that we understand the past happened but that today is a brand new issue we haven’t seen before.

We’ve gotten very comfortable over the last ten or so years. There had been very little volatility, wars we didn’t pay too much attention to, as they had dragged on for decades. We’d made easy returns. We were extremely cozy…

Then January 1, 2022.

We as Canadians have suffered fools thinking they deserve a separate set of rules and freedoms than the rest of us, who attempted a coup in front of our eyes, and as a collective, we mostly ignored them. Cozy.

We’ve been told that inflation would be an issue for the last couple years for very obvious reasons, and panicked when our governments decided it was time to step in, even though we’d had ample warning. Snug as a bug.

The Russian oligarchy and its lead tyrant has been warning of war on his western flank for years, and we ignored his posted notices for a good while, even after they’d illegally annexed a very important strategic region and port away from its homeland. Easy livin’ complacency.

Right now, our largest obstacle to regaining the ground we made up last year is currently chucking missiles at Ukraines capital, Kiev. The best our governments in the west can do is sanctions and somewhat harsh words. We don’t know what is going to happen half a world away. We simply don’t. A reckless and unpredictable government which answers to 0% of the people it governs pushes for conflict in a region that has spent the last few decades fighting and winning its outright independence and stands in outright defiance of this lunacy.

And rightfully so. Freedom is hard fought, and unfortunately the sacrifices required create martyrs, legends and hero’s in its wake.

I digress.

If we look back through modern history, markets react favorably to the creation of these hero’s and martyrs. An unfortunate byproduct of war tends to be a lot of spending and buying. In a world where we prepare for war, which is much more profitable than peace, it is very likely we will make solid returns if this initial wave of violence leads to outright war in Eastern Europe.

Not sure if this could possibly be true?

Here is an excerpt from a recent update from Sébastien McMahon. Chief economist and fund manager at Industrial Alliance:

A close look at historical stock market reactions to military events

Although there is no certainty around a geopolitical conflict duration and its impact on the markets, historical data shows that, in most cases, markets recover in the following months.

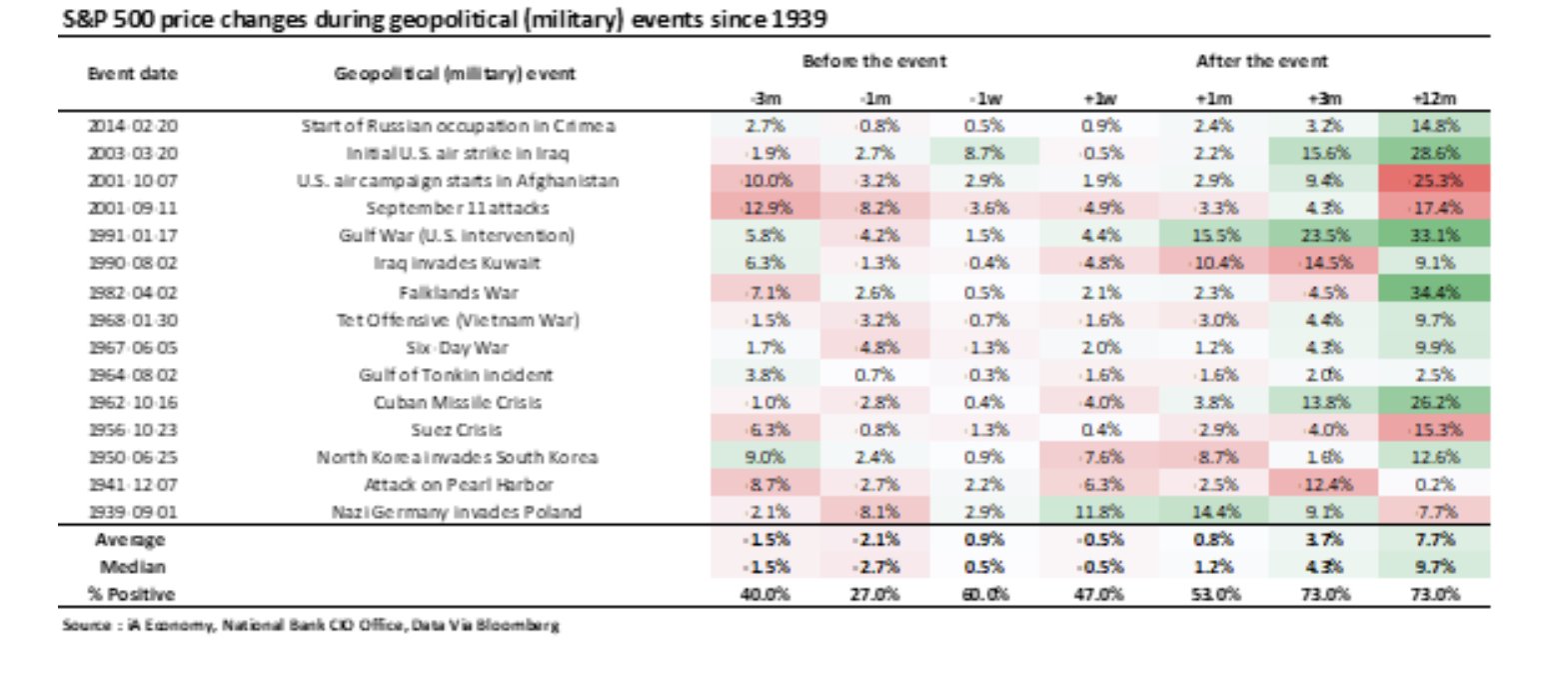

The chart below shows the S&P 500 price variations during military events that have occurred since 1939. As we can see, 12 months after the start of each conflict, the markets had not only recovered, but also went up in nearly 75% of the cases: source

History tells us that most of the time, war is good for your retirement funds. And since we don’t fight wars on North American soil, we don’t have to concern ourselves with the rebuilding of our community and society. But someone else does, and somewhere else will, and we are positioned with our portfolio to take advantage of this in the coming months and years.

As a society, we probably don’t learn from history. It’s easy to tell, because we continue to make the same mistakes, over and over, and panic in the same ways with little regard for the past.

It bears repeating from posts we’ve made over the years that “this too shall pass” and we can again become comfortable. But until it does, please remember the most simple and fundamental truths of the markets.

Tragedy + time = positive market returns.

This is an unfortunate truth, and also my career. Imagine what dad has gone through in 45 years…

9-11 + 20 years war in Iraq = 20 years of incredible market returns. (~13% compounded annually)

Millions of people lose their homes after greedy banks and governments give away loans to people who couldn’t afford them + generational recession = 11+ years of steady market growth and an average annual compounded growth (2008-2020) of 13.05% for Financial Value Inc. clients.

Tsunami + nuclear disaster + 12 months = 12.34% returns

Declaration of worldwide pandemic + six months = 60%+ return on capital

It doesn’t even take much time to turn tragedy into profits. I am sure we would all simply rather not profit off of war or human tragedy, but the fact remains, when we strip all emotion from the situation we find ourselves in, our nest eggs, retirement funds, pensions, emergency funds and play money will not be harmed by whatever happens in Ukraine over the long term. We won’t have to rebuild our province or nation. Our freedoms and home aren’t up for grabs.

I know I am being pretty heavy handed here, but in our complacency, we perhaps require some bottom line perspective on the situation we are facing from Alberta out. History is a very strong crutch we can rely on and right now I would suggest we lean hard on history and become as stoic as possible. Time will show and provide for us, as it always does.

Daily and weekly volatility can be pretty scary. Learning of war breaking out is pretty scary. Rising interest rates can be a little scary. Inflation isn’t any fun. Political instability is pretty horrible. None of these things last forever. The only constant, is that market values continue to move up and to the right. They have nowhere else to go.

Thank you, dad and I hope to see you soon.

If you are able and willing, please consider donating to one of the below aid organizations.

The Canadian Government is matching up to $10,000,000 in donations under $100,000 each

Voices of Children (Children.org)

Vostok-SOS - Evacuation efforts

Malteser International - Food, supplies, aid

Many more can be found online, please be sure to research your sources of donation prior to donation.

Darris Cameron

CEO

Financial Value Inc.